The benchmark VN-Index on the Ho Chi Minh Stock Exchange inched down 0.18 percent to close at 767.49 points. The key index dropped 1.12 percent on July 17.

On the Hanoi Stock Exchange, the HNX-Index was down just 0.04 percent to end at 98.6 points after a 1.8-per-cent fall in the last session.

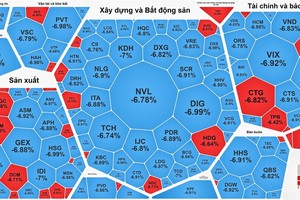

Blue chips remained on a downward spiral as 22 of the top 30 largest shares by market value and liquidity on the main bourse in HCM City lost value, and only seven advanced.

Gainers included banks, with three of the four largest listed lenders – Vietcombank (VCB), BIDV (BID) and Military Bank (MBB) – increasing 0.1-0.5 percent.

Smaller banks like Sacombank (STB) in HCM City’s market, Asia Commercial Bank (ACB) and Sai Gon-Hanoi Bank (SHB) on the Hanoi Stock Exchange picked up 0.8-3.4 percent each.

Industry-leading companies, such as PV Gas (GAS), VinGroup (VIC), Bao Viet Holdings (BVH), Hoa Phat Group (HPG), FPT Corp (FPT), Kido Group (KDC), Masan Group (MSN), Mobile World Group (MWG) and Saigon Securities Inc (SSI) continued to slide.

Overall market breadth was negative with 287 stocks declining, 159 rising and 264 closing unchanged on the two markets.

“Although selling pressure eased compared to the previous two sessions, a reliable signal of a reversal has yet to come,” Tran Duc Anh, a stock analyst at Bao Viet Securities Company wrote in July 18’s report. He suggested investors maintain stock exposure at a moderate level and avoid raising it until the risk of a short-term decline is removed.

Liquidity decreased slightly with a total of 292.5 million shares worth 5 trillion VND (221.4 million USD) being traded on the two bourses, down 12.6 percent in volume and 10.7 percent in value compared to July 17’s figures.

Foreign traders returned net buyers on the two markets on July 18 after a short selling in the previous session, picking up shares worth a combined net value of nearly 86 billion VND.

On July 17, the HCM Stock Exchange announced it was adding shares of FLC Faros Construction Corp (ROS), Novaland Investment Group (NVL) and brewery Sabeco (SAB) to the basket of the VN30, which tracks the 30 largest shares by market value and liquidity on the southern bourse.

Three companies – Hoang Anh Gia Lai Co (HAG), Hoang Anh Gia Lai Agricultural Investment Co (HNG) and Tan Tao Investment Industry Corp (ITA) – were removed from the basket.

The new basket takes effect from July 24 to January 19, 2018.

The VN30 has expanded 18.7 percent since the beginning of this year, outperforming the 15.6 percent growth of the VN-Index as of July 17.

On the Hanoi Stock Exchange, the HNX-Index was down just 0.04 percent to end at 98.6 points after a 1.8-per-cent fall in the last session.

Blue chips remained on a downward spiral as 22 of the top 30 largest shares by market value and liquidity on the main bourse in HCM City lost value, and only seven advanced.

Gainers included banks, with three of the four largest listed lenders – Vietcombank (VCB), BIDV (BID) and Military Bank (MBB) – increasing 0.1-0.5 percent.

Smaller banks like Sacombank (STB) in HCM City’s market, Asia Commercial Bank (ACB) and Sai Gon-Hanoi Bank (SHB) on the Hanoi Stock Exchange picked up 0.8-3.4 percent each.

Industry-leading companies, such as PV Gas (GAS), VinGroup (VIC), Bao Viet Holdings (BVH), Hoa Phat Group (HPG), FPT Corp (FPT), Kido Group (KDC), Masan Group (MSN), Mobile World Group (MWG) and Saigon Securities Inc (SSI) continued to slide.

Overall market breadth was negative with 287 stocks declining, 159 rising and 264 closing unchanged on the two markets.

“Although selling pressure eased compared to the previous two sessions, a reliable signal of a reversal has yet to come,” Tran Duc Anh, a stock analyst at Bao Viet Securities Company wrote in July 18’s report. He suggested investors maintain stock exposure at a moderate level and avoid raising it until the risk of a short-term decline is removed.

Liquidity decreased slightly with a total of 292.5 million shares worth 5 trillion VND (221.4 million USD) being traded on the two bourses, down 12.6 percent in volume and 10.7 percent in value compared to July 17’s figures.

Foreign traders returned net buyers on the two markets on July 18 after a short selling in the previous session, picking up shares worth a combined net value of nearly 86 billion VND.

On July 17, the HCM Stock Exchange announced it was adding shares of FLC Faros Construction Corp (ROS), Novaland Investment Group (NVL) and brewery Sabeco (SAB) to the basket of the VN30, which tracks the 30 largest shares by market value and liquidity on the southern bourse.

Three companies – Hoang Anh Gia Lai Co (HAG), Hoang Anh Gia Lai Agricultural Investment Co (HNG) and Tan Tao Investment Industry Corp (ITA) – were removed from the basket.

The new basket takes effect from July 24 to January 19, 2018.

The VN30 has expanded 18.7 percent since the beginning of this year, outperforming the 15.6 percent growth of the VN-Index as of July 17.