The benchmark VN-Index inched up 0.15 percent to close at 767.99 points on the HCM Stock Exchange. The southern market index rose nearly 1 percent in two days.

On the Hanoi Stock Exchange, the HNX-Index edged up 0.39 percent to end at 99.80. The northern market index expanded 1.5 percent in the two previous sessions.

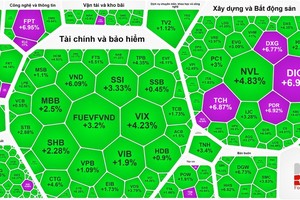

Bank stocks continued to attract money, with eight of nine listed banks gaining value. Only Vietcombank (VCB) slipped 0.5 percent, other banks like Eximbank (EIB), Sacombank (STB), Military Bank (MBB) and BIDV (BID) posted gains of between 2.8 percent and 6.5 percent.

Speculation on bank shares was generated by reports that the National Assembly is likely to approve the bad debt settlement resolution this week. The resolution is expected to ease bottlenecks in bank debt restructuring and boost overall performance of the banking sector.

Apart from banks, pharmaceutical shares also saw positive trading. Big drug companies like DHG Pharmaceutical (DHG), Traphaco (TRA), Pharmedic Pharmaceutical Medicinal (PMC), Ha Tay Pharmaceutical (DHT) and Domesco Medical Import Export (DMC) rose by between 1-7.5 per cent.

The overall market trend was positive with 253 stocks picking up, 212 falling and 234 closing unchanged.

Investment was mostly spurred by the possibility that MSCI will publish the Frontier Market Index and Emerging Market Index on June 21.

If Vietnam is included in the Emerging Market waiting list or increases its rank on the Frontier Market Index, exchange-traded funds (ETFs) and other international financial institutions may increase Vietnamese stock in their portfolios, boosting their investments in the local market.

“Large-cap stocks will have a bigger chance of receiving foreign capital as investment policy of most funds and financial institutions focuses on leading large-cap stocks,” analysts at BIDV Securities Co wrote in a note.

Liquidity surged on June 20 with a total of 297 million shares worth a combined 5.53 trillion VND (243.6 million USD) being traded in the two markets, up 12 percent in volume and 8.4 percent in value compared to June 19’s figures.

Foreign traders continued to be net buyers in the two markets, picking shares worth total net value of 67 billion VND. Their net buys reached 161 billion VND in the last two days.

On the negative side, some blue chips slumped under rising profit-taking, like Vinamilk (VNM), VinGroup (VIC), Bao Viet Holdings (BVH), Masan Group (MSN), PV Gas (GAS) and FPT Corp (FPT).