At the end of September, the VN-Index exceeded 900 points, increasing by nearly 3 percent compared to the previous month, ranking fourth in the top ten stock markets with the highest increase in September, behind Mongolia (4.27 percent), Turkey (4.06 percent), and Denmark (3.48 percent). In August, the VN-Index also recorded the best growth in the world with nearly 10.5 percent and was one of the ten strongest indexes in the third quarter of this year.

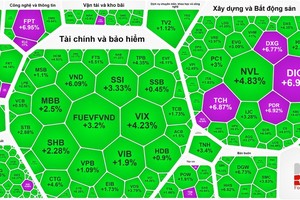

After advancing for two consecutive months, in the first two weeks of October, the VN-Index continues to have trading sessions with sharp increases and is currently hovering around 930 points, only down by more than 4 percent compared to the peak at the beginning of this year. The market is on the rising momentum. The second week of October is the fourth consecutive week of increase and also the 9th winning week in the last ten weeks. This gaining streak is even better than that in the period of last April and May. Many stocks have surpassed their pre-Covid-19 prices. Of which, most banking stocks rose sharply from the bottom of March this year. Some banking stocks jumped by over 50 percent, such as HDB with 72 percent and ACB and STB with 60 percent. Several penny stocks, including TTF, TLD, VID, MCP, soared by from 120 percent to nearly 174 percent, compared to the beginning of this year. Some stocks even skyrocketed by 300-500 percent. For instance, DNM rallied 488 percent, and SCI strengthened 350 percent.

According to Viet Dragon Securities Company, Vietnam's stock market surged robustly in August and September and performed better than other stock markets, such as South Korea, the US, and Thailand. It has partly reflected positive information on GDP growth in the third quarter of this year of Vietnam compared to other countries.

Specifically, according to a report by Nikkei Asian, Vietnam ranks first in Southeast Asia in terms of economic performance with positive third-quarter GDP growth of 2.12 percent. Meanwhile, other countries in the region expect to have lower or negative GDP growth. Another noticeable factor that increases the adjustment capability of the VN-Index is the announcement of business results in the third quarter of all listed stocks in October this year.

In the context of continuous net selling of foreign investors on the market from March 2020 to now, the domestic capital inflow has brought into play its internal strength to help Vietnam's stock market to make the breakthrough and recover quickly. According to securities experts, the participation of the capital flow of new domestic investors (also known as F0 investors) has poured into the bottom fishing market, helping the VN-Index, from 650 points at the end of March, to advance to near 930 points.

According to data from the VSD, in the first nine months of this year, domestic investors had opened nearly 253,000 new accounts, an increase of 64,000 accounts compared to the whole year 2019. Of which, the number of new accounts opened since the outbreak of Covid-19 has reached nearly 225,000 accounts.

Thanks to strong cash flow, market liquidity also increased sharply. The average trading value of VND3 trillion per trading session from March this year has soared to nearly VND5.5 trillion per trading session in September, the highest figure since the first quarter of 2018 - the time when the VN-Index set its historical peak with more than 1,200 points.

According to experts, the attractiveness of the stock market includes many factors. Specifically, the bank savings interest rate has continuously decreased in recent months; other investment channels contain high risks, such as domestic gold prices standing at high levels with a large difference compared to the global gold prices. The liquidity of the real estate channel is poor due to the Covid-19 pandemic, and the corporate bond channel has gradually been tightened as the Government's Decree No.81/2020 takes effect from the beginning of September this year, urging the cash flow to pour more strongly into the stock market.

Recently, the Ministry of Finance is launching a consultation on a draft circular guiding the operation of securities companies, replacing Circular No.210/2012/TT-BTC and Circular No.07/2016/TT-BTC. One of the most noticeable contents in the new draft circular is the addition of some regulations related to opening securities trading accounts in the direction of legal completion so that securities companies can open remote accounts. If this draft is accepted, the regulation on opening remote trading accounts will help investors to participate in the stock market more conveniently. Thereby, securities companies and the market can receive more new cash flows.

After advancing for two consecutive months, in the first two weeks of October, the VN-Index continues to have trading sessions with sharp increases and is currently hovering around 930 points, only down by more than 4 percent compared to the peak at the beginning of this year. The market is on the rising momentum. The second week of October is the fourth consecutive week of increase and also the 9th winning week in the last ten weeks. This gaining streak is even better than that in the period of last April and May. Many stocks have surpassed their pre-Covid-19 prices. Of which, most banking stocks rose sharply from the bottom of March this year. Some banking stocks jumped by over 50 percent, such as HDB with 72 percent and ACB and STB with 60 percent. Several penny stocks, including TTF, TLD, VID, MCP, soared by from 120 percent to nearly 174 percent, compared to the beginning of this year. Some stocks even skyrocketed by 300-500 percent. For instance, DNM rallied 488 percent, and SCI strengthened 350 percent.

According to Viet Dragon Securities Company, Vietnam's stock market surged robustly in August and September and performed better than other stock markets, such as South Korea, the US, and Thailand. It has partly reflected positive information on GDP growth in the third quarter of this year of Vietnam compared to other countries.

Specifically, according to a report by Nikkei Asian, Vietnam ranks first in Southeast Asia in terms of economic performance with positive third-quarter GDP growth of 2.12 percent. Meanwhile, other countries in the region expect to have lower or negative GDP growth. Another noticeable factor that increases the adjustment capability of the VN-Index is the announcement of business results in the third quarter of all listed stocks in October this year.

In the context of continuous net selling of foreign investors on the market from March 2020 to now, the domestic capital inflow has brought into play its internal strength to help Vietnam's stock market to make the breakthrough and recover quickly. According to securities experts, the participation of the capital flow of new domestic investors (also known as F0 investors) has poured into the bottom fishing market, helping the VN-Index, from 650 points at the end of March, to advance to near 930 points.

According to data from the VSD, in the first nine months of this year, domestic investors had opened nearly 253,000 new accounts, an increase of 64,000 accounts compared to the whole year 2019. Of which, the number of new accounts opened since the outbreak of Covid-19 has reached nearly 225,000 accounts.

Thanks to strong cash flow, market liquidity also increased sharply. The average trading value of VND3 trillion per trading session from March this year has soared to nearly VND5.5 trillion per trading session in September, the highest figure since the first quarter of 2018 - the time when the VN-Index set its historical peak with more than 1,200 points.

According to experts, the attractiveness of the stock market includes many factors. Specifically, the bank savings interest rate has continuously decreased in recent months; other investment channels contain high risks, such as domestic gold prices standing at high levels with a large difference compared to the global gold prices. The liquidity of the real estate channel is poor due to the Covid-19 pandemic, and the corporate bond channel has gradually been tightened as the Government's Decree No.81/2020 takes effect from the beginning of September this year, urging the cash flow to pour more strongly into the stock market.

Recently, the Ministry of Finance is launching a consultation on a draft circular guiding the operation of securities companies, replacing Circular No.210/2012/TT-BTC and Circular No.07/2016/TT-BTC. One of the most noticeable contents in the new draft circular is the addition of some regulations related to opening securities trading accounts in the direction of legal completion so that securities companies can open remote accounts. If this draft is accepted, the regulation on opening remote trading accounts will help investors to participate in the stock market more conveniently. Thereby, securities companies and the market can receive more new cash flows.