Last year, the number of banks and real estate enterprises that issued bonds to attract capital accounted for a large proportion of the market. In January this year alone, real estate companies lured more than 50 percent of the total amount of money mobilized in the bond market.

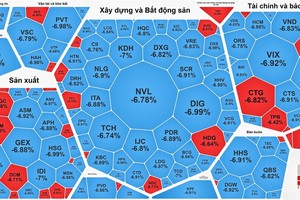

In recent years, many large real estate companies have a capital value of tens of trillions of Vietnamese dong but their stock prices have dropped to below VND10,000 per share. Now, banking stocks have been experiencing the same situation.

For instance, Saigon Hanoi Commercial Bank stocks (SHB) were below par value although its pre-tax profit exceeded VND3 trillion last year. Similarly, the price of Kien Long Bank’s stocks (KLB) also hovered at its IPO value. Even the price of Lien Viet Post Bank’s stocks (LPB) was merely above VND7,000 per share.

When the stock prices plummet heavily, it means that the capital mobilization channel in the stock market is no longer attractive. Banks cannot issue more stocks to increase their capitals at the face value because the market prices are lower, so there will be no buyers.

If any units accept to buy these stocks at the face value, these units might be associated companies, buying stocks to share each other’s business segments. Once an enterprise listed on the stock market is to use the stock market as a capital mobilization channel. If that function becomes useless, listing no longer has meaning.

However, nearly 1,000 enterprises and banks listed on both Hanoi Stock Exchange and Ho Chi Minh City Stock Exchange whose market price of their stocks was below the par value, accounting for 40 percent of the total number of the listed company in the stock market. This means that these loss-making enterprises will face many difficulties in selling their stocks to mobilize capital.

‘Currently, the economy begins to encounter difficulties as the growth cycle starts to fall into crisis, affected by the Covid-19 pandemic so investors become more cautious and study carefully the business performance of enterprises before buying their stocks. Therefore, if any enterprises that do not have developed, transparent business performance, they will not be able to mobilize capital in the stock trading floor,’ said Associate Professor – Ph.D. Le Vu Nam, Vice-Principal of the University of Economics and Law under the Vietnam National University - Ho Chi Minh City.

Last year, many enterprises used the bond market as their capital mobilization channel because it does not require strict requirements as the stock market. Therefore, the bond market was vibrant last year.

From when the risk ratio of real estate loans was set at a high level, causing real estate companies to be difficult to access the bank loans, the promulgation of the Decree No.163/2018/ND-CP with many open regulations has helped enterprises to boost bond issuance. Many enterprises have offered an interest rate of 14 percent per annum, much higher than the deposit interest rate of banks to draw more investors.

Figures by the Vietnam Bond Market Association showed that there were more than 900 turns of bond issuance of more than 200 enterprises with the total issuance value of nearly VND297 trillion. Of which, real estate enterprises issued VND106.5 trillion, accounting for about 38 percent. In January this year alone, they issued more than VND7.3 trillion worth of bonds, accounting for more than 50 percent of the total bond issuance in the month.

However, mobilizing capital through the bond channel might lead risks to individual investors who do not know any information as well as the real financial situation of these enterprises. The Ministry of Finance has repeatedly warned of this situation.

According to the ministry, at the present, enterprises mainly issued bonds through private offering that was unprofessional and had not fully complied with regulations on information disclosure and issuance process. Therefore, investors in the bond market might face many risks, such as enterprises do not perform the conditions and terms of bonds, fail to pay fully and timely the capital and interest of bonds, and do not fulfill commitments with investors on buying back bonds before maturity.

At the end of last year, Deputy Prime Minister Vuong Dinh Hue entrusted the Ministry of Finance to evaluate and review to amend the Decree No.163/2018/ND-CP on corporate bond issuance. Currently, the ministry is drafting a revision of the Decree No.163/2018/ND-CP towards tighter control on the bond market to protect investors and safety for the market.

For instance, enterprises with small capital scale will not be allowed to issue a large number of bonds. The number of bonds issued will be limited to ensure that the outstanding bond issue of the private placement of the enterprise does not exceed three times higher than the equity in the latest quarterly financial statement approved by a competent authority. If enterprises want to issue the number of bonds three times higher than their equity, they have to make a public offering that meets requirements and conditions like those of the stock market. The new decree even restricts the interest rate level to ensure the market to develop healthily.

As a result, it is forecast that after the new decree is released, the bond channel will no longer be a fertile land for enterprises to attract capital. Along with the current strict regulations of banks, loss-making enterprises will be unable to mobilize capital.

In recent years, many large real estate companies have a capital value of tens of trillions of Vietnamese dong but their stock prices have dropped to below VND10,000 per share. Now, banking stocks have been experiencing the same situation.

For instance, Saigon Hanoi Commercial Bank stocks (SHB) were below par value although its pre-tax profit exceeded VND3 trillion last year. Similarly, the price of Kien Long Bank’s stocks (KLB) also hovered at its IPO value. Even the price of Lien Viet Post Bank’s stocks (LPB) was merely above VND7,000 per share.

When the stock prices plummet heavily, it means that the capital mobilization channel in the stock market is no longer attractive. Banks cannot issue more stocks to increase their capitals at the face value because the market prices are lower, so there will be no buyers.

If any units accept to buy these stocks at the face value, these units might be associated companies, buying stocks to share each other’s business segments. Once an enterprise listed on the stock market is to use the stock market as a capital mobilization channel. If that function becomes useless, listing no longer has meaning.

However, nearly 1,000 enterprises and banks listed on both Hanoi Stock Exchange and Ho Chi Minh City Stock Exchange whose market price of their stocks was below the par value, accounting for 40 percent of the total number of the listed company in the stock market. This means that these loss-making enterprises will face many difficulties in selling their stocks to mobilize capital.

‘Currently, the economy begins to encounter difficulties as the growth cycle starts to fall into crisis, affected by the Covid-19 pandemic so investors become more cautious and study carefully the business performance of enterprises before buying their stocks. Therefore, if any enterprises that do not have developed, transparent business performance, they will not be able to mobilize capital in the stock trading floor,’ said Associate Professor – Ph.D. Le Vu Nam, Vice-Principal of the University of Economics and Law under the Vietnam National University - Ho Chi Minh City.

Last year, many enterprises used the bond market as their capital mobilization channel because it does not require strict requirements as the stock market. Therefore, the bond market was vibrant last year.

From when the risk ratio of real estate loans was set at a high level, causing real estate companies to be difficult to access the bank loans, the promulgation of the Decree No.163/2018/ND-CP with many open regulations has helped enterprises to boost bond issuance. Many enterprises have offered an interest rate of 14 percent per annum, much higher than the deposit interest rate of banks to draw more investors.

Figures by the Vietnam Bond Market Association showed that there were more than 900 turns of bond issuance of more than 200 enterprises with the total issuance value of nearly VND297 trillion. Of which, real estate enterprises issued VND106.5 trillion, accounting for about 38 percent. In January this year alone, they issued more than VND7.3 trillion worth of bonds, accounting for more than 50 percent of the total bond issuance in the month.

However, mobilizing capital through the bond channel might lead risks to individual investors who do not know any information as well as the real financial situation of these enterprises. The Ministry of Finance has repeatedly warned of this situation.

According to the ministry, at the present, enterprises mainly issued bonds through private offering that was unprofessional and had not fully complied with regulations on information disclosure and issuance process. Therefore, investors in the bond market might face many risks, such as enterprises do not perform the conditions and terms of bonds, fail to pay fully and timely the capital and interest of bonds, and do not fulfill commitments with investors on buying back bonds before maturity.

At the end of last year, Deputy Prime Minister Vuong Dinh Hue entrusted the Ministry of Finance to evaluate and review to amend the Decree No.163/2018/ND-CP on corporate bond issuance. Currently, the ministry is drafting a revision of the Decree No.163/2018/ND-CP towards tighter control on the bond market to protect investors and safety for the market.

For instance, enterprises with small capital scale will not be allowed to issue a large number of bonds. The number of bonds issued will be limited to ensure that the outstanding bond issue of the private placement of the enterprise does not exceed three times higher than the equity in the latest quarterly financial statement approved by a competent authority. If enterprises want to issue the number of bonds three times higher than their equity, they have to make a public offering that meets requirements and conditions like those of the stock market. The new decree even restricts the interest rate level to ensure the market to develop healthily.

As a result, it is forecast that after the new decree is released, the bond channel will no longer be a fertile land for enterprises to attract capital. Along with the current strict regulations of banks, loss-making enterprises will be unable to mobilize capital.