The benchmark VN-Index on the HCM Stock Exchange inched down 0.09 percent to close Friday at 777.60 points. The HNX-Index on the Hanoi Stock Exchange dropped 0.33 percent to end at 100.43 points.

Friday’s declines ended a three-day rally on both local bourses, with the VN-Index advancing a total 1.5 percent and the HNX-Index going up 0.4 percent.

The two local indices finished the trading week with a mixed direction. The VN-Index posted a weekly gain of 0.2 percent while the HNX-Index fell 1.1 percent.

Daily average trading liquidity declined from the previous week by 25.6 percent in volume and 10.3 percent in value to 230.5 million shares and VNĐ2.26 trillion (US$189.5 million).

According to brokerage companies and analysts, both local indices will remain firm at the current score range of between 770 and 780 points as investors are cautious over the market’s negative trading conditions.

Bao Viet Securities Co (BVSC) said in its weekly report that Friday’s decline had made market trading conditions unpredictable.

As the benchmark VN-Index recorded a slight weekly increase and the HNX-Index retreated from the previous week’s closing level, investors clearly have reasons to wait for more positive signals.

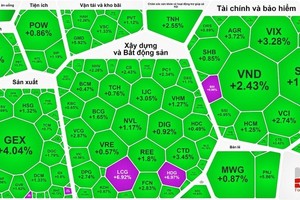

Though some key large-cap stocks rebounded and pulled the two local markets up, investor sentiment was still weak, especially after the two indices continuously hit their fresh highs in recent weeks.

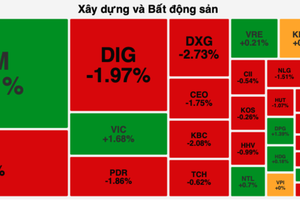

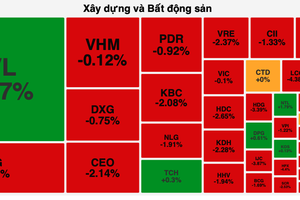

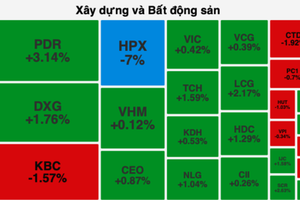

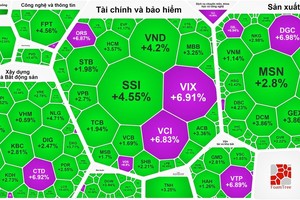

Shares of leading firms such as PetroVietnam Gas (GAS), Petrolimex (PLX), dairy producer Vinamilk (VNM), insurance-finance group Bao Viet Holdings (BVH), property developer Vingroup (VIC) and steelmaker Hoa Phat Group (HPG) advanced between 0.5 percent and 4.6 percent.

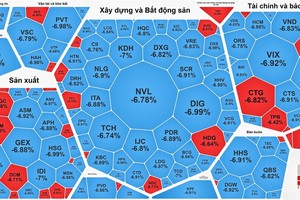

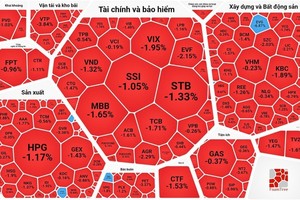

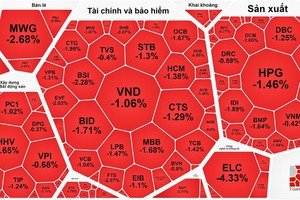

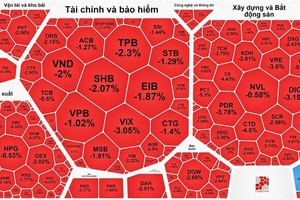

On the opposite side, trading of bank and brokerage shares remained negative after strong increases in the previous period.

Shares of the three largest banks on the stock market, Vietcombank (VCB), Vietinbank (CTG) and BIDV (BID), finished last week down between 1.2 percent and 4.4 percent.

Shares of securities firms also saw their prices fall. Sacombank Securities (SBS) slumped 7.7 percent, Bao Viet Securities (BVS) and Vietinbank Securities (CTS) edged down 0.6 percent each.

Mixed performance of local shares and falling trading liquidity proved that both sellers and buyers were hesitating to trigger their purchasing power, according to Chau Thien Truc Quynh, an analyst at Viet Capital Securities Co.

One of the major driving factors for the stock market at the moment is second-quarter and first-half earnings reports, Quynh said, adding that would also be the reason for the mixed performance of the stock market this week.

MB Securities analyst Nguyen Duy Dinh said investors had priced in shares of companies, which had been forecast to release good earnings for the second quarter and the first half of the year, and it is now the time for them to sell stakes and earn short profits.